Click on Image to Enlarge

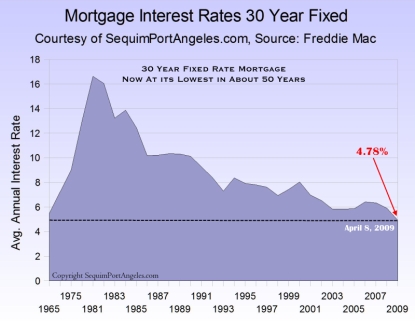

In the early 1960’s a loaf of bread was 35 cents, a dozen eggs 50 cents, a gallon of milk 75 cents, and a postage stamp was only 5 cents. A 30 year fixed rate mortgage was in the 5% range. Today that same mortgage interest rate is 4.78%, the lowest it has been in 50 years.

No wonder there is a spurt of buyer activity in California, Nevada, and from Bellingham to Port Angeles. It has become apparent to even the average person that now is the time to pull the trigger and buy a house or have one built.

There’s a unique convergence of circumstances right now that makes this an extraordinary buyer’s market.

First, interest are the lowest they’ve been in 50 years. Does anyone think for a second that interest rates are going any lower? No, but they will go back up.

Second, real estate prices are dragging rock bottom and have been for a while. Many homes have been selling for less than the mortgage balance. It is just not likely there is much room, if any, for real estate prices to go lower, especially with buyers stepping back into the market so suddenly.

Third, the inventory of homes for sale is the best it has been in my three decades in the business, although I do think buyers are cherry picking the best homes on the market.

In a market where you had one or two of these circumstances, you would have a buyer’s market. Now we have all three, which I call an extraordinary buyer’s market. Soon this opportunity will be gone. There is no doubt about this.

Last Updated on September 2, 2019 by Chuck Marunde