Sequim investors have been disappointed that there are not more real opportunities to purchase foreclosures at deep discounts. Everyone knows foreclosures are up nationwide, but there are several states with very high rates that push the national average way up and push this news to the frontpage.

Sequim investors have been disappointed that there are not more real opportunities to purchase foreclosures at deep discounts. Everyone knows foreclosures are up nationwide, but there are several states with very high rates that push the national average way up and push this news to the frontpage.

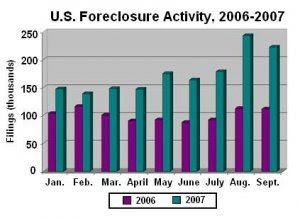

“The highest rate, for the ninth month in a row, was in Nevada, which had 1 filing for every 185 households. Florida was No. 2, with 1 filing for every 253 households, followed by California with 1 for every 253 households. Other states with foreclosure rates in the Top 10 last month were Michigan, Arizona, Georgia, Ohio, Colorado, Texas and Indiana.” Providence Business News, Chart Couresy RealtyTrac, Inc.

We have not seen such high foreclosures in Washington State. Certainly, we will see more. While a foreclosure is sad news for the homeowner being foreclosed upon (because of a loss of a job, divorce, or some other major financial crisis), it does present opportunities for buyers with cash. During any kind of downturn in real estate, the old rule still applies: Cash is King!

If you do have funds to purchase foreclosures, please be aware of the traps for the unwary. If you haven’t been buying foreclosures for years (and even if you have), you would be well advised to get help from a professional who understands foreclosures and how to purchase them at the lowest possible price SAFELY. See help elsewhere on this site on buying foreclosures.

Last Updated on April 17, 2013 by Chuck Marunde

Very nice web site!! We’ve been looking at homes on your online Sequim MLS site, and we’ve looked at foreclosures too, but your article that talks about the best homes in the best areas at the best prices was very helpful. We gave up trying to find our retirement home among the foreclosure list. You were right. The best homes we would want to live in the rest of our lives are not crappy foreclosures, but homes that are being sold by homeowners that are not in distress. Thank you so much for the guidance you give buyers like us. I told my husband you were a real estate attorney for 20 years, and he really liked the idea that when we are ready to buy we would have a Realtor who really knows the business and how to help us negotiate the best price. We’ve had a bad experience with a Realtor before, and frankly so many really don’t have much experience. My husband and I (and a few of our friends) often joke about inexperienced agents by talking about “housewives who got a real estate license.” We don’t mind working with a man or a woman. We just want an agent who actually has some knowledge and experience in all things real estate, not a housewife (no matter how sweet or wonderful she is) who has no experience in business, no experience in legal issues or contract language, no experience in marketing, and no experience in negotiating. We don’t know how other buyers search for their agents, but we are certainly aware of the need to find a buyer’s agent who knows real estate. Thanks again for your articles and all the free information you give away. We both think what you do is fantastic.

Is it possible for small overseas investor to foreclosure properties in the usa? In Singapore, it’s easy to do so.

It’s a myriad of laws and regulations. I would always advise to get expert help in these matters. You are dealing with a lot of money and I understand that people will try to get the best deals possible for themselves when in situations like these, so why shouldn’t you protect your assets.

I saw that graph on a news before and I was not shock that this thing is happening in the US. This foreclosure resulted from borrowers with subprime loans and adjustable rate mortgages that initially had attractive interest rates but then can adjust upward, resulting in a payment shock.

I was searching for Blogs about home forclosure appraisal website and found this site. I am interested in your content and appreciate sites like this. Gulf to Bay Appraisals

Good question. There are many traps, and I’ll write a full article on this, but here are a few. 1.) I had a client who came to me after he thought he bought a house at a foreclosure sale, but he actually bought a second mortgage. The first mortgage balance was more than the house was worth. He lost his $50,000. 2.) I know a gentlemen who bought a foreclosure only to find out later that a substantial number of the beams under the house had to be replaced because of rotten timbers. He said after all the money and time, he will be lucky to break even. 3.) Buying pre-foreclosure or negotiating a great price on a house prior to the trustee’s sale could be great, but a purchase can be subject to unknown subordinate mortgages, mechanic’s liens, labor liens, federal tax liens, assessments, and judgments, not to mention possible permit violations, boundary disputes with neighbors, easement or access problems, adverse possession claims or easement by prescription claims, and about 100 other possible legal issues. It’s dangerous out there. Be careful.

What are some of the traps or pitfalls in buying foreclosure properties?