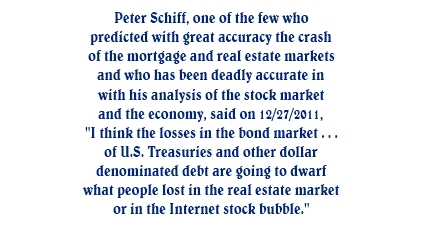

What is the real estate market and the U.S. economy going to do in 2012? Here is my read on the real estate market and the the economy for 2012. In terms of credibility in writing an article on the economics of both the real estate market and the U.S. Economy, just for your information, I have a degree in economics (with an emphasis on monetary policy), a degree in teaching, a doctorate in law, and 37 years as a business owner, lawyer, registered financial adviser, certified estate planner, business consultant, and real estate broker. While that certainly doesn’t guarantee anything about the accuracy of my perspective, the so-called experts and talking heads on T.V. have been wrong far more than they’ve been right since 2005. The odds are my prediction will be more accurate than the talking heads who never warned us of the impending doom until after the fact.

The Real Estate Market

There are economic cycles and patterns that tend to repeat themselves over time, but these past five years have seen variables thrown into the mix that no economic model has ever had to include in the predictive programming. No Ph.D. has ever lived through such times with so many variables and so many potentially complex outcomes. The John Keynes economists have blown a fuse trying to figure out how to run fiscal spending and taxation models and not run the country over the cliff. The Milton Friedman economists believe monetary policy is running amok and has been hijacked by social terrorists.

The truth is the politicians have no clue how to solve the problems they got us into. While we are on the brink of defaulting on our debt, and Europe has sprung such large leaks they can’t seem to bail water fast enough, the truth is no one knows what will happen in 2012. No one knows precisely because there are literally thousands of economic variables at play. Governments all around the world now control many of these variables, and business owners who are the engine of employment, are at the mercy of politicians and government agencies calling all the shots. Free enterprise is no longer functioning as the economic engine of the greatest laissez faire system the world has ever seen.

The Real Estate Market and U.S. Economy

So what is my best guess for 2012? I believe Europe will not sink into the ocean. Greece and many European countries are learning a hard lesson my father taught me when I was a child: You cannot spend more than you make or it will catch up with you. European style socialism is catching up with them, and it is painful. But I don’t believe Europe will sink and drag the U.S. into a depression. There will be much uncertainty, and periodic threats of disaster, but the ones who will suffer the most will be the Europeans. Unions will be busted, not by people or government, but by pure economic forces. Excessive government salaries and benefits are about to end. The massive government gravy train is coming to a screeching halt in Europe and in the U.S.

The U.S. economy is going to suffer a long painful transition, too. But first politicians will insist on taking us to the very brink of financial disaster. This is how they operate. They will continue to operate like that, but in the end, the U.S. will not sink into economic oblivion. There will be major adjustments in the size of government at all levels until it is reduced so we can survive. There will be adjustments to taxation and regulations for small businesses, but not before millions of small businesses are driven into bankruptcy. Politicians are not proactive. They are reactive, and it is always the citizens who pay the greatest price.

There is pent-up demand while consumers and corporations have put many plans on hold while they wait for more clarity as to where this nation and economy is going. It is the great uncertainty right now that is holding some major players back. U.S. corporations are sitting on $5 trillion in cash and cash equivalents right now. That is double the amount last year. GE is sitting on $139 billion in cash, Apply $76 billion in cash, Microsoft $53 billion in cash, Cisco $43 billion in cash, and Google $39 billion in cash. These cash reserves exist because of uncertainty.

I believe the U.S. economy will stay in the doldrums for most of 2012. There will be signs of improvement, but as I’ve written elsewhere, beware of government statistics that promise we are in a recovery when we may not be. We will not experience a depression, but we will not feel like we are in a recovery either.

The real estate market will be bifurcated, and there will be two major segments. The first real estate market segment will consist of the houses that are owned by Americans who are not in default and not in financial trouble. Many of these homes will be sold at reasonable prices and bought by qualified buyers who pay as much as 20% down and qualify for a conventional loan. Fannie Mae and Freddie Mac will play a lesser role in the years ahead, and FHA insured and VA guaranteed loans will make up a smaller percentage of the total loan inventory. The elimination of entire secondary and tertiary markets of highly leveraged derivatives will see that Fannie and Freddie play lesser roles. This first segment of the real estate market consisting of the nice homes buyers want will behave much more like a normal real estate market in a slow economy. This real estate market will appear to be normal with activity and in some areas of the country will be very good.

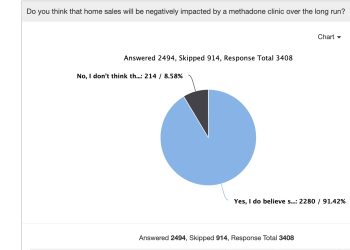

The second segment of the real estate market will behave quite differently. This is the real estate market consisting of homes in default, foreclosed homes now owned by banks, and homes with mortgages in the loan modification process (of which their will be more). The foreclosure market is chaotic at best, and there is little adult supervision in the process from the asset manager to the bank to the real estate agent. The lack of knowledge, the lack of efficient systems to handle the listing and negotiating and sales of the homes, and the chaos that has taken hold will continue to make this market extremely inefficient. Foreclosures will stagnate on the market, not only because buyers don’t want many of these homes, but because of the inefficiencies in how they are handled. It is in this second segment where we will see prices continue to decline, and the NAR and government stats will not separate these two segments.

This means we will have inaccurate or skewed housing statistics in 2012 purporting to show that housing prices are still declining. That will confuse some buyers who will be told that prices are declining, because the houses in the first real estate market segment will not decline in price and some will actually be increasing in price, depending on the location and the home itself. To get the foreclosures sold, banks will have to drop the prices substantially, because many of these foreclosures are homes that no one wants. Because banks are not staffed with real estate experts that know how to efficiently do this, many foreclosures stagnate on the market overpriced for one to two years before banks finally “get it” and drop the prices so they will get sold. This kind of behavior creates very ugly housing statistics.

A trend that started in 2007 and will continue throughout 2012 is the closure of the big bricks-and-mortar real estate brokerages. It is unfortunate, but the traditional high overhead real estate business model is in big trouble. The real estate industry has been in a dramatic time of change, and traditional brokers have not adapted to the changes in demand, marketing, technology and the Internet. In Washington 2011 has seen the closure of Windermere offices, RE/Max offices, John L. Scott offices, consolidations, mergers, and the CEO of John L. Scott just resigned (or was fired). I created a new business model for real estate brokerage about four years ago to meet consumer demand and the changes taking place. As a result, I’ve been quite busy, and I’m looking to hire agents from Port Angeles to Sequim and down to Silverdale and Bremerton. In 2012 we will see more traditional offices close all over the country. [See a book written on this subject, The New World of Marketing for Real Estate Agents by Chuck Marunde]

The Real Estate Market v. U.S. Economy

Other areas of our economy will go up and down during 2012, and the news media will report we are in a recovery one week based on an improved import/export ratio, or unemployment applications, or bond rates, or the slow but upward trend of the S&P 500. But the next week the same news media will report that we are not in a recovery and a further recession is threatened by some major corporate layoffs, or the possible bankruptcy of the state of California, or another political battle over whether to bail Fannie Mae out or let her sink out of existence (with all the implications that would reverberate throughout the real estate and mortgage industry).

The stock market will be volatile throughout 2012, and if you have retirement funds managed by someone you have never met who also manages billions of dollars for other people, there may be more losses. The volatile markets will cause some of these money managers to take unnecessary risks with other people’s money. [See Funds Go Out of Business and Keep an Eye on Advisers and Fund Managers] The markets have been moving sideways, and there’s no big indication the market will start trending upward in 2012. For all those funds who preach “buy and hold for the long term,” there is trouble brewing. Let’s hope we don’t hear stories like the Madoff story or the unfolding Corzine disaster. My personal motto is “don’t trust strangers with your life savings.”

There will be many bright spots in 2012. The first segment of the real estate market with the nice homes that buyers really want will be a decent market and will see some modest improvements in price and demand. This will not be reported, because the foreclosure segment will pull the stats down. For those qualified buyers who have the down payments and the credit to invest in additional rental homes, 2012 will offer an opportunity for tens of thousands of Americans to amass more equity and wealth over the next 7 to 10 years in real estate since the 1970’s when FHA loans were assumable for $45.

There will be many bright spots in 2012. The first segment of the real estate market with the nice homes that buyers really want will be a decent market and will see some modest improvements in price and demand. This will not be reported, because the foreclosure segment will pull the stats down. For those qualified buyers who have the down payments and the credit to invest in additional rental homes, 2012 will offer an opportunity for tens of thousands of Americans to amass more equity and wealth over the next 7 to 10 years in real estate since the 1970’s when FHA loans were assumable for $45.

Individual investors will do well if they are wise and careful. Many “master traders” are doing quite well managing their own funds in the stock market, but that is not for everyone. It takes tremendous education and training, which few people can do in order to become their own professional money manager. But because of the volatility in the stock market, commodity market, options, futures, and the niche markets, 2012 will actually produce many millionaires.

Entrepreneurship is in a time of dramatic change, too. The extraordinary developments and pace of growth in technologies and the rapid acceleration in the use of the Internet by all ages, combined with changing consumer demand and preferences, all means that there are more opportunities for entrepreneurs today than there ever have been. I also think that more people will start low overhead home businesses in 2012 than in past years. The idea of building multiple streams of income and diversifying has been picking up momentum for a decade now, and the financial challenges of this recession have revived the interest in home based businesses. We are living in a time of unbelievable opportunities and 2012 will be a banner year for creative business opportunities.

I believe all things considered, 2012 is going to be my best year ever. I hope it will be your best year, too.

Last Updated on December 27, 2011 by Chuck Marunde

I’ve been thinking about whether the real estate market is at a bottom or not. I guess no one really knows, but it does seem like the market has stablized near or at the bottom. Prices haven’t dropped but neglibibly in the past months compared to earlier.

i bleave that the world “As we know it will end in 2012 because of mass panic look at the world market

Jeremy, I came back to review your comment after 11 years, and I guess it’s fair to say your not a prophet. But thanks for playing.